does nh tax food

But while the state has no personal income tax and no sales tax it has the fourth. The tax is 625 of the sales price of the meal.

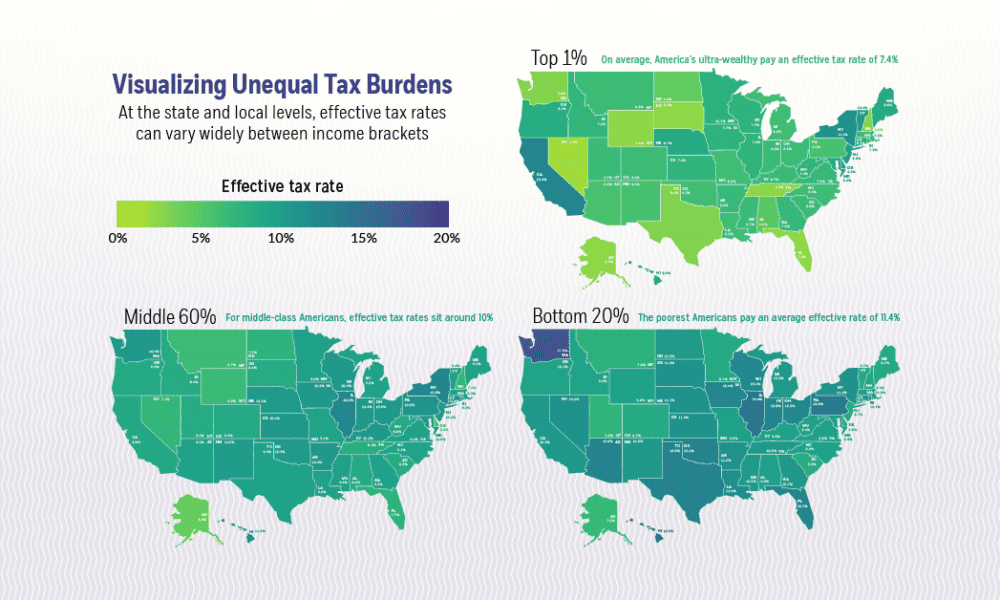

Mapped Visualizing Unequal State Tax Burdens Across America

These excises include a 9 tax on.

. A Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. Does Nh Have Food Tax. Does Nh Have Food Tax.

New Hampshire is one of the few states with no statewide sales tax. Does New Hampshire have food or sales tax. New Hampshire does tax income from interest and dividends however.

New Hampshire is known as a low-tax state. Please note that effective october 1 2021 the meals rentals tax rate is reduced from 9 to 85. The tax is paid by the consumer and collected by operators of hotels restaurants or other businesses providing taxable meals room rentals.

Main Street Concord NH 03301-4989 or by calling 603 271-3246. Accordingly New Hampshire is listed as NA with footnote 11. State sales tax rate.

1m9fakbx Rkyhm 1800 per 31-gallon barrel or 005 per 12-oz can. While New Hampshire does not collect a sales tax excise taxes are levied on the sale of certain products including alcohol cigarettes tobacco and gasoline. New Hampshire Consumer Taxes at a Glance New Hampshire does not have a sales tax and has some of the lowest gasoline taxes in the countrySince the state controls all.

107 - 340 per gallon or 021 - 067 per 750ml. How does New Hampshire make money. As a result the state of New Hampshire levied just 78 worth of income tax per capita in the fiscal year 2018 compared to a national average of 1303.

The 2017 maximum benefit permitted for an eligible household of three with no net income is 511 per month which is approximately 549 per person. Does nh tax food. Does nh tax food.

At the top end of the. The 8080 rule applies when 80 of your sales are food and 80 of the food you sell is taxable. New Hampshire has no.

What is not taxed in New Hampshire. New businesses must register by writing to the NH Secretary of States Office Corporate Division 107 N. A 7 tax on phone services.

Please note recently enacted legislation. A 9 tax is also assessed on motor vehicle rentals. There are however several specific taxes levied on particular services or products.

There is currently a 9 sales tax in NH on prepared meals in restaurants along with the same rate on short-term room rentals and car rentals. Does nh tax food. How much is property tax in New Hampshire.

Concord NH 03305 603 271-2382 Who pays it. Sales Tax Treatment of. Is it cheaper to live in Vermont or New Hampshire.

State Sales Tax On Groceries Ff 09 20 2021 Tax Policy Center

State Sales Tax Free Weekend Shopping Just Updated 2022

Food Sales Tax On States Chopping Blocks The Pew Charitable Trusts

With No State Income Tax Where Does Texas Get Its Money Curious Texas Investigates

Why Are Minnesotans So Overtaxed American Experiment

Understanding California S Sales Tax

Understanding California S Sales Tax

5 States With No Sales Tax Forbes Advisor

:max_bytes(150000):strip_icc()/5_states_without_sales_tax-5bfc38cbc9e77c00519e5498.jpg)

Which States Have The Lowest Sales Tax

Sales Taxes In The United States Wikipedia

Is New Hampshire Really As Anti Tax As It S Cracked Up To Be Stateimpact New Hampshire

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation

States Without Sales Tax Article

Sales Tax Laws By State Ultimate Guide For Business Owners

New Hampshire Fights Supreme Court Sales Tax Ruling Wsj

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)